Figures of the Article

-

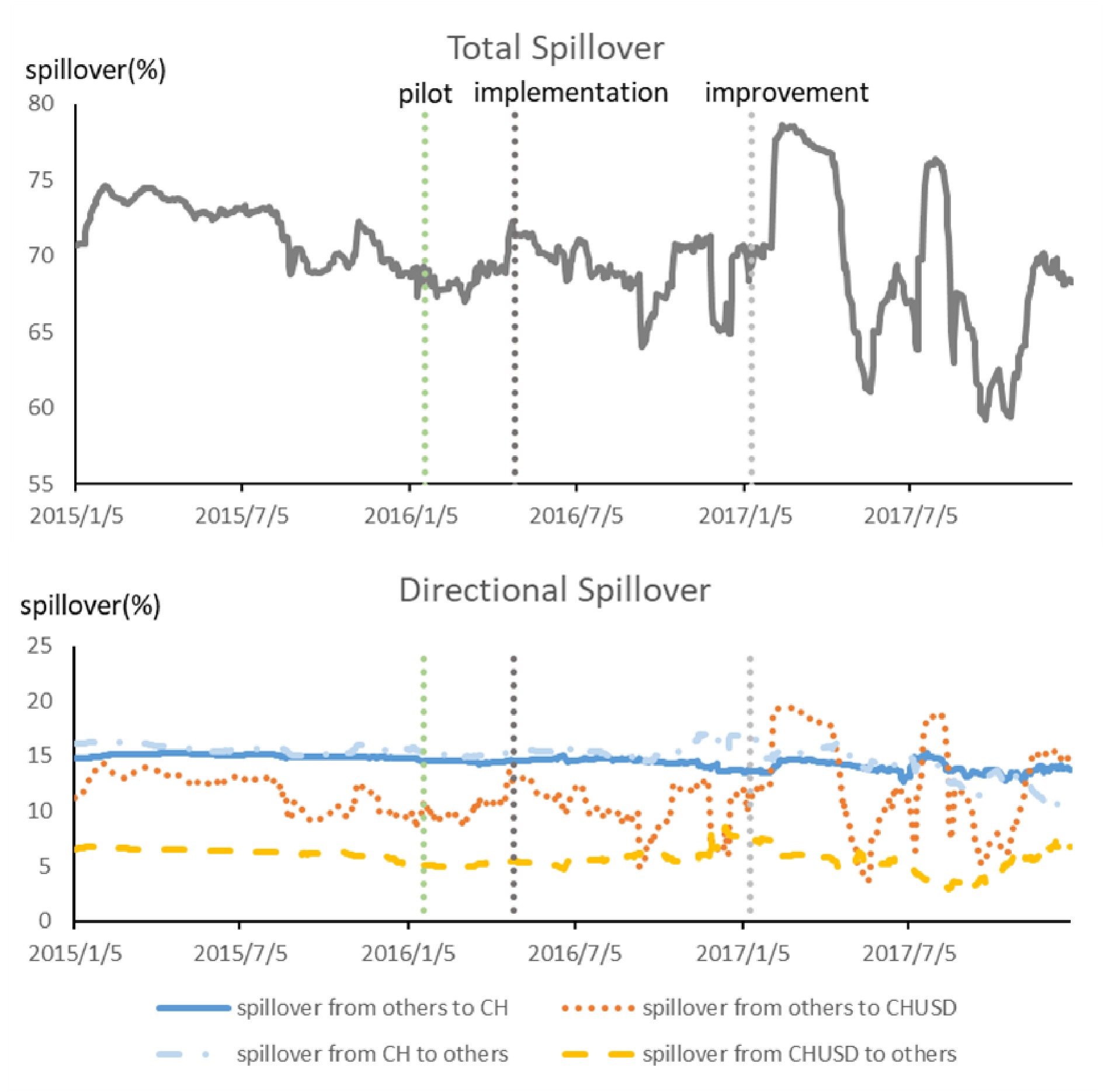

![]() Total spillover and directional spillover. The total spillover effect equals 1– (Σ the spillover effect from A to A), where A represents any bond market. The spillover effect from others to CH means that the Chinese RMB bond market received spillover effects from other bond markets. The spillover effect from CH to others means that the Chinese RMB bond market imposes a spillover effect on other bond markets. The spillover effect of CHUSD is the same as that of CH.

Total spillover and directional spillover. The total spillover effect equals 1– (Σ the spillover effect from A to A), where A represents any bond market. The spillover effect from others to CH means that the Chinese RMB bond market received spillover effects from other bond markets. The spillover effect from CH to others means that the Chinese RMB bond market imposes a spillover effect on other bond markets. The spillover effect of CHUSD is the same as that of CH.

-

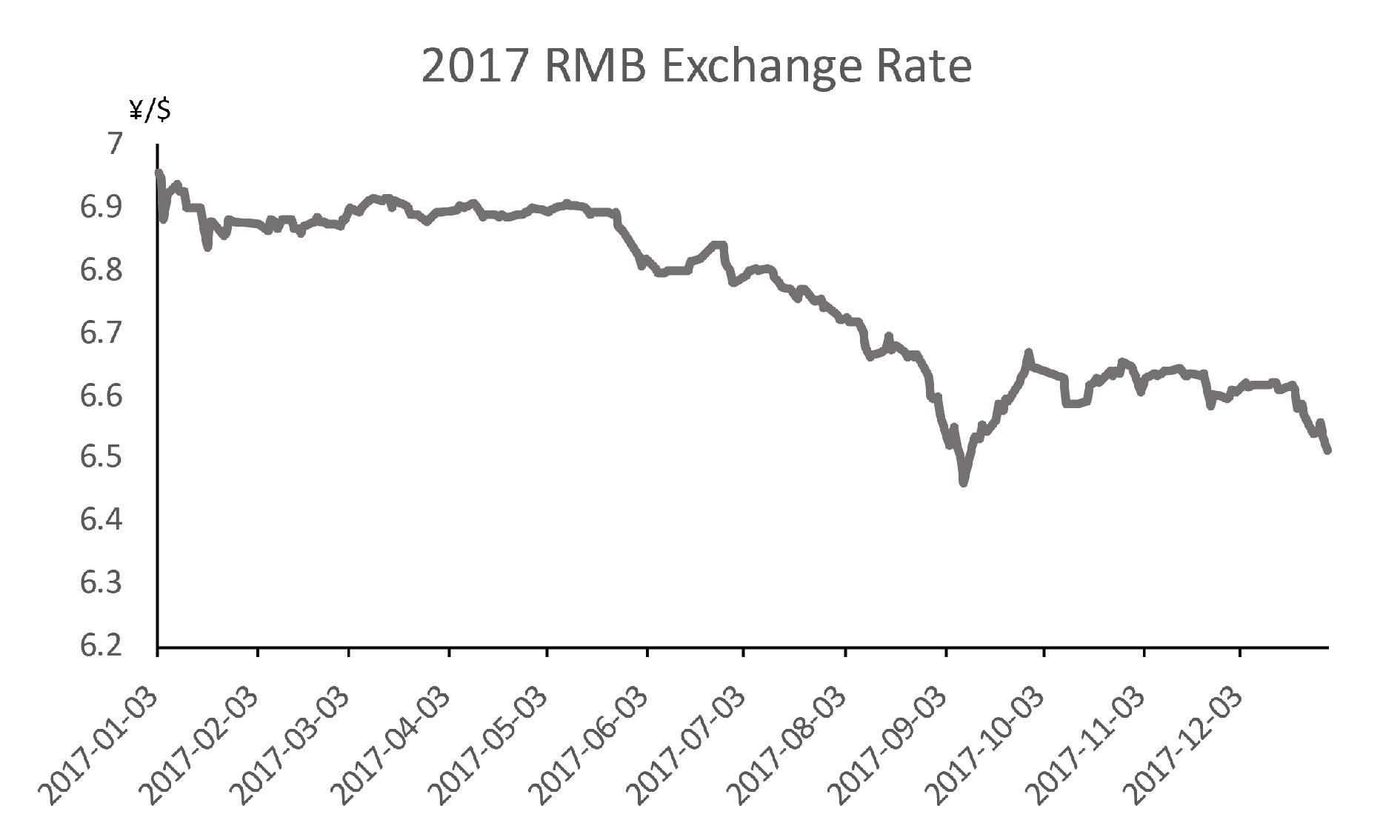

![]() RMB exchange rate in 2017.

RMB exchange rate in 2017.

-

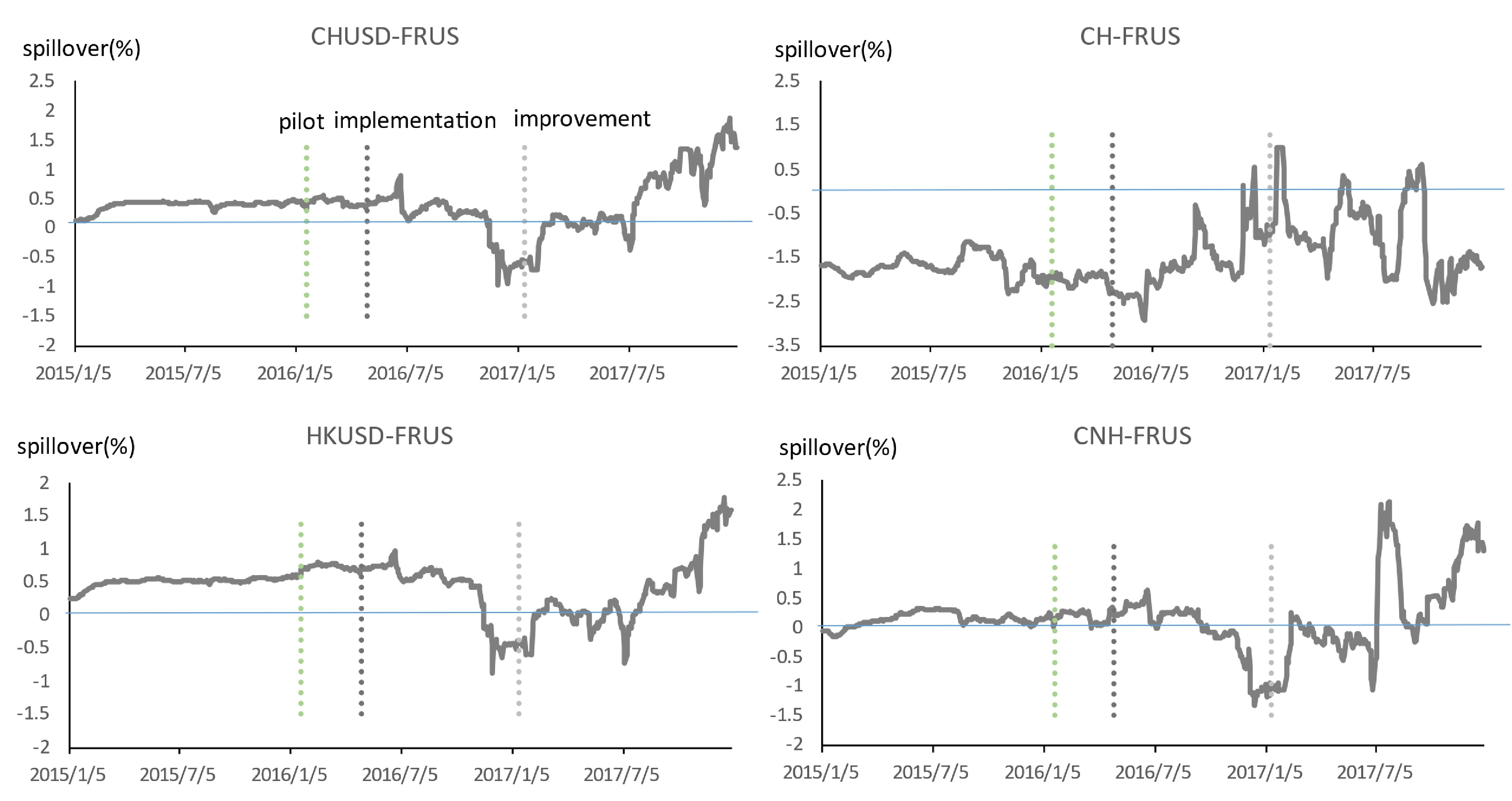

![]() Net pairwise spillover. Note: Taking the first picture as an example, a positive net paired spillover effect means that the spillover effect from the Chinese USD Bond Index to the FTSE Russel US Bond Index is greater than the spillover effect from the FTSE Russel US Bond Index to the Chinese USD Bond Index.

Net pairwise spillover. Note: Taking the first picture as an example, a positive net paired spillover effect means that the spillover effect from the Chinese USD Bond Index to the FTSE Russel US Bond Index is greater than the spillover effect from the FTSE Russel US Bond Index to the Chinese USD Bond Index.

-

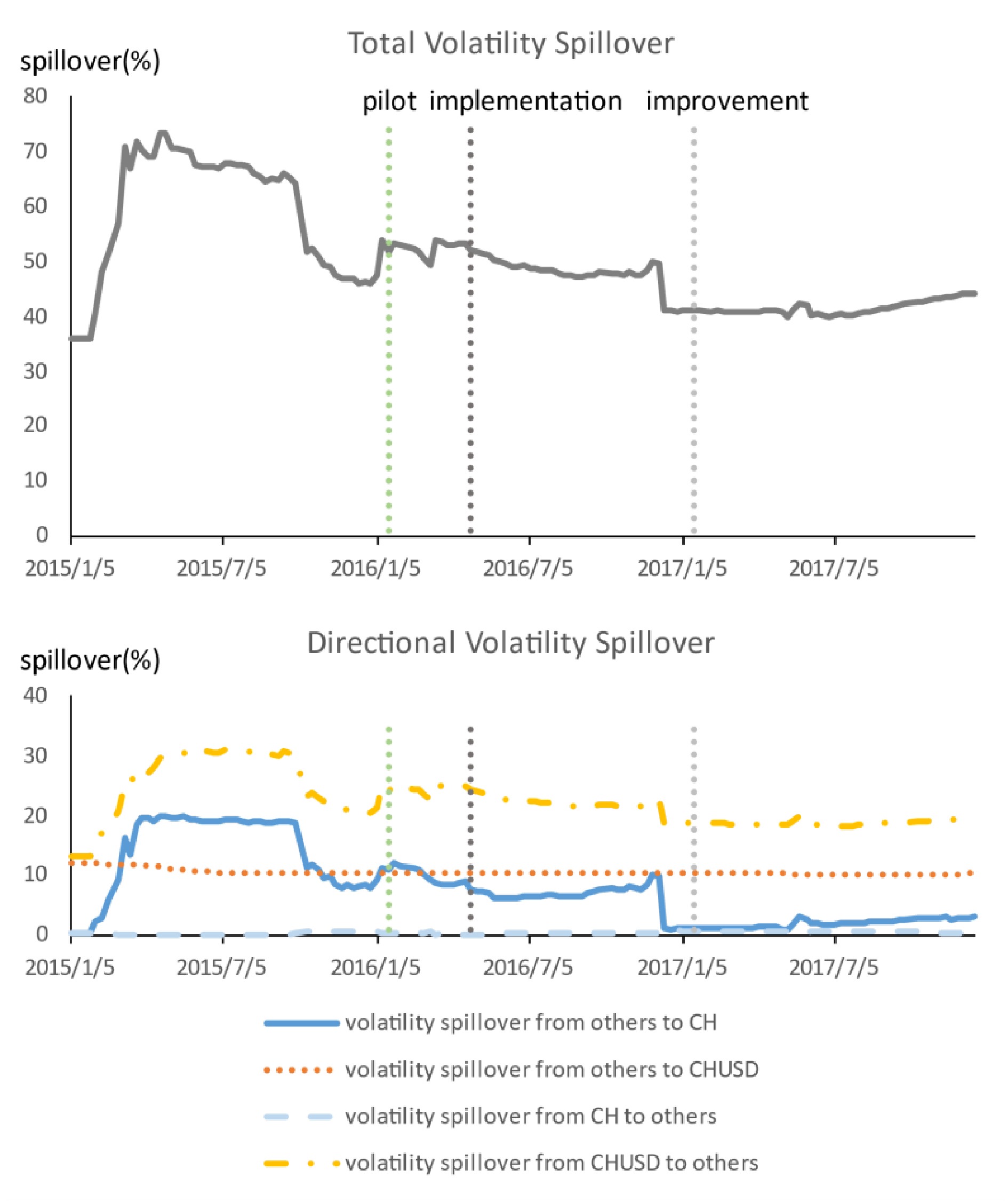

![]() Total and directional volatility spillover.

Total and directional volatility spillover.

-

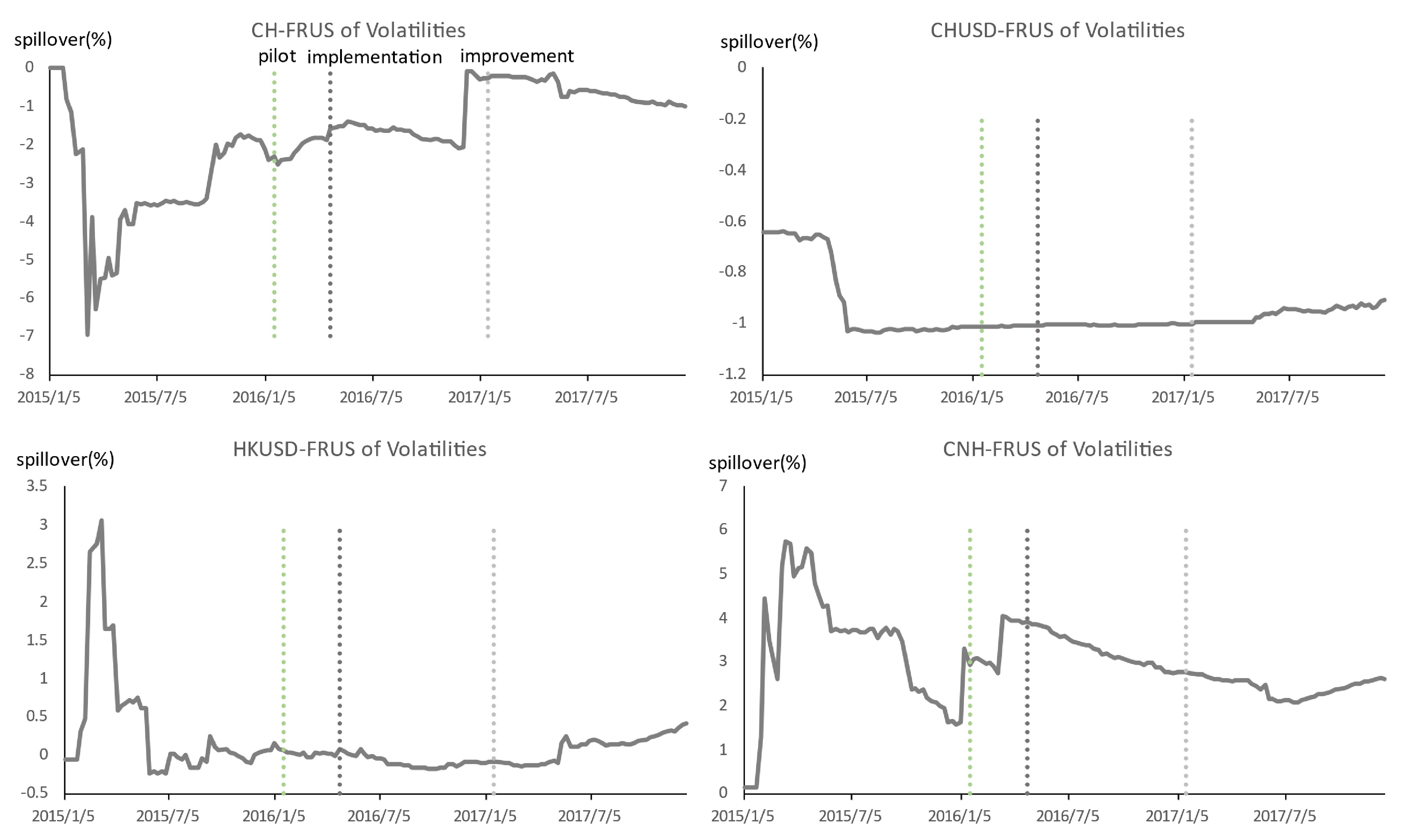

![]() Net pairwise volatility spillover. Taking the first figure as an example, a positive net pairwise spillover effect means that the spillover effect from Chinese RMB Bond Index volatility to US Bond Index volatility is greater than the spillover effect from US Bond Index volatility to Chinese RMB Bond Index volatility; net pairwise spillovers.

Net pairwise volatility spillover. Taking the first figure as an example, a positive net pairwise spillover effect means that the spillover effect from Chinese RMB Bond Index volatility to US Bond Index volatility is greater than the spillover effect from US Bond Index volatility to Chinese RMB Bond Index volatility; net pairwise spillovers.

-

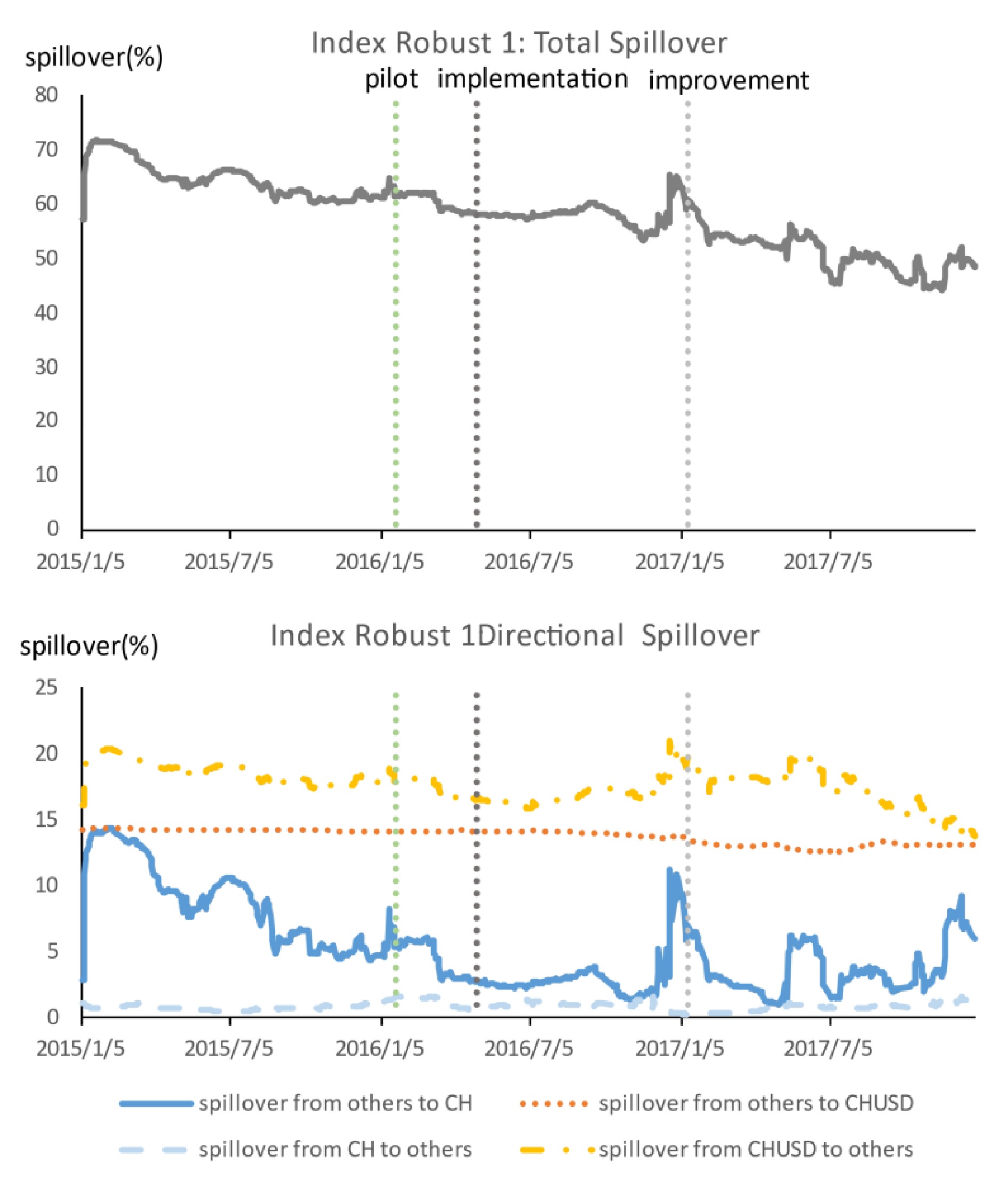

![]() Index robust 1: FRUS change to FREU.

Index robust 1: FRUS change to FREU.

-

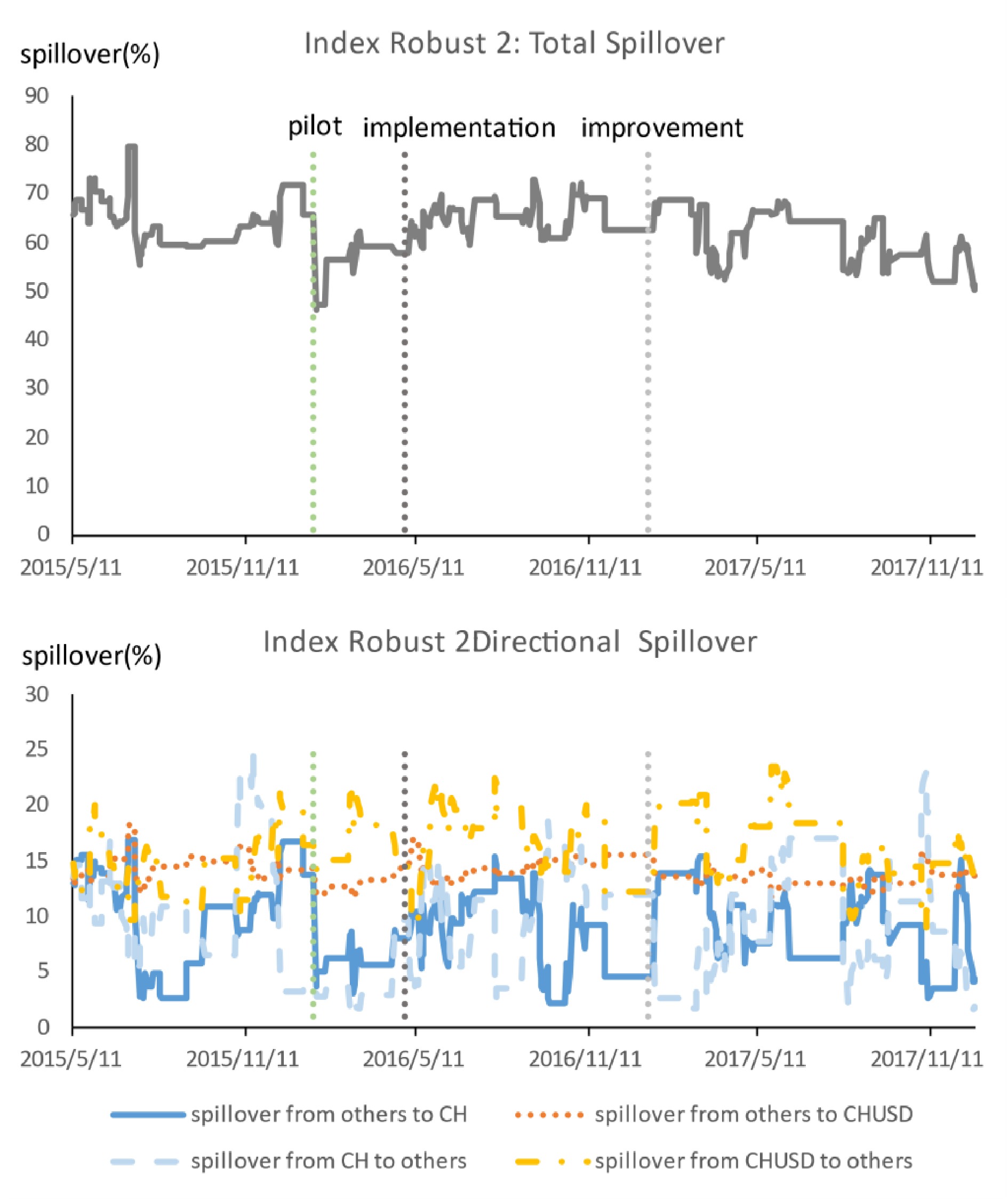

![]() Index robust 2: TVP-VAR change to VAR.

Index robust 2: TVP-VAR change to VAR.

-

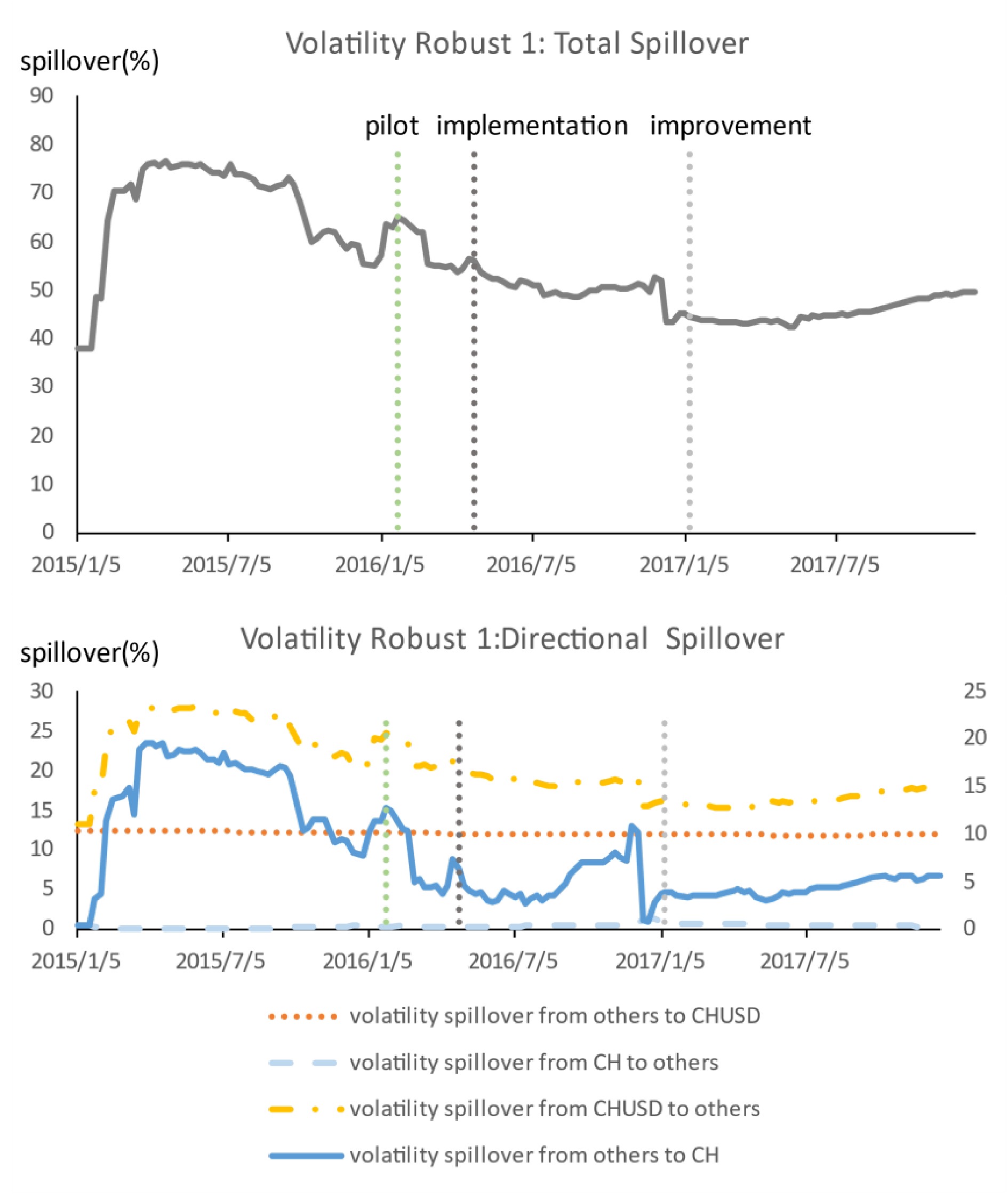

![]() Volatility robust 1: FRUS change to FREU.

Volatility robust 1: FRUS change to FREU.

-

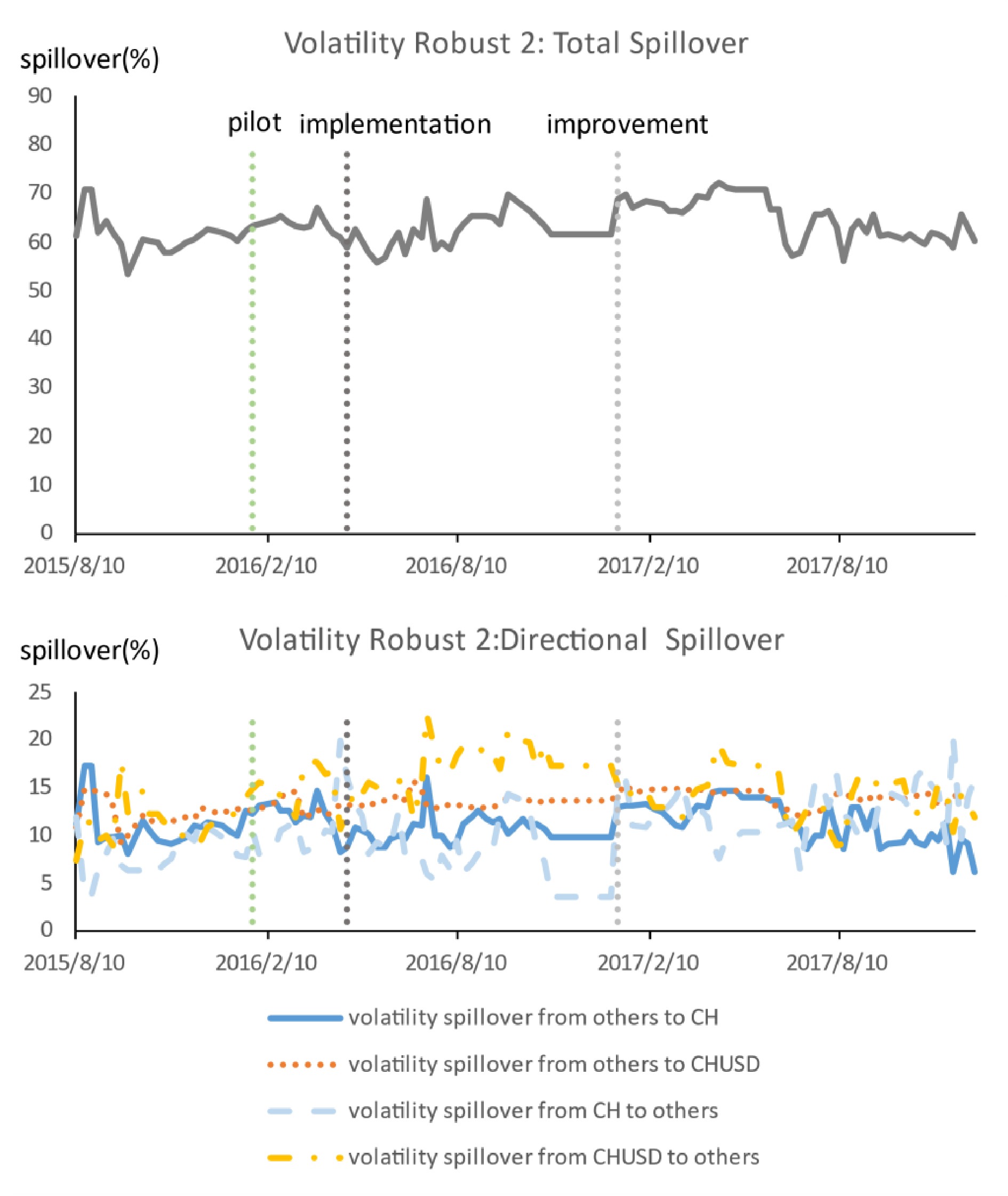

![]() Volatility robust 2: TVP-VAR change to VAR.

Volatility robust 2: TVP-VAR change to VAR.

Download:

Download: